How to Use Property Capital Gains Tax (CGT) in the UK to Your Advantage as a Property Investor or Homeowner

Understand the basics of CGT and how it applies to your UK property investments

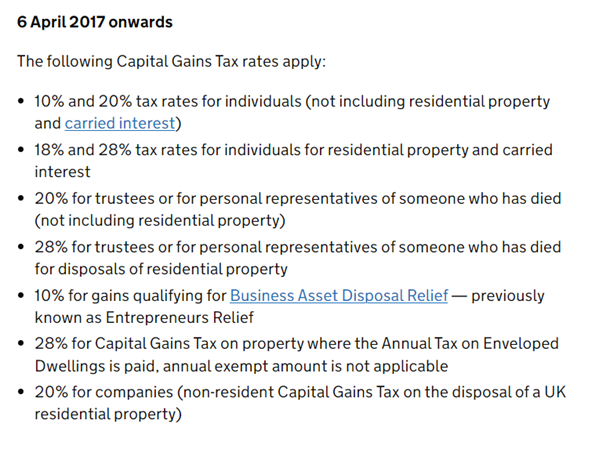

For the upcoming 2023/2024 tax year, your capital gain rate depends on your overall annual income. If you make below £50,270 annually then 10% of every profit made is taxable (18% for residential property). Conversely if your yearly take-home surpasses £50,270 then a more substantial rate of 20% applies (28% for real estate profits) across all gains.

You are expected to pay CGT on the following:

- Business premises

- Buy-to-let properties

- Inherited properties

- Land

- Second homes

Learn about different exemptions that you can use when selling a property in the UK

When it comes to selling a residential property in the UK, it’s important to understand the different exemptions you can use to reduce your tax liability. One of the most significant taxes you’ll need to consider is capital gains tax (CGT), which is payable if you make a profit on the sale of your property.

Depending on your circumstances, you may be eligible for a range of exemptions, such as principal private residence relief (PPR). This allows you to claim relief on your main residence, meaning you won’t need to pay CGT on any profit you make. There are also other exemptions available if you’re selling a property that was once your main residence, as well as special rules for trustees.

With rates of 18% or 28% payable on taxable gains, it’s important to understand how you can minimize your tax bill when selling a property in the UK.

Executors and personal representatives

If you’re acting as an executor or personal representative for a deceased person’s estate, you may get the full annual exempt amount during the administration period.

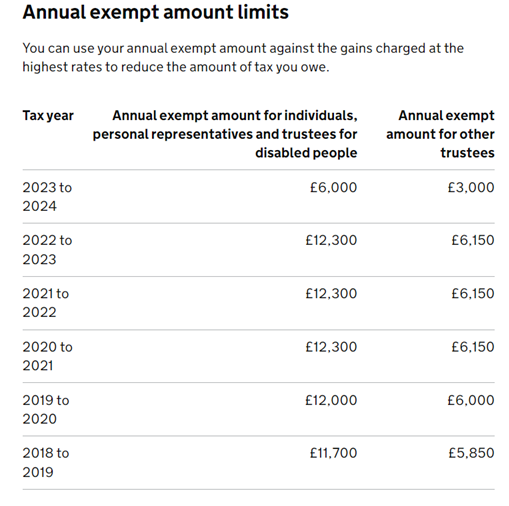

You can benefit from a yearly tax allowance for 3 years following the death of your loved one. This exemption helps relieve some financial pressures during such trying times and allows you to care for their estate without hefty taxation burdens weighing on top of it all. Act soon, as after those three years this annual exempt amount will no longer apply.

Trustees for disabled people

Acting as a trustee for someone with mental health issues or eligible to receive Attendance Allowance or Disability Living Allowance? You are entitled to the ‘Individuals, personal representatives and trustees for disabled people’. The annual exempt amount table has you covered. This Capital Gains Tax rate is specifically tailored to those individuals and their personal representatives, offering peace of mind during difficult times.

If you’re non-domiciled in the UK

If you’ve been born abroad and plan to return there, then it’s likely that you’ll have non-domiciled status in the UK. In this case, claiming remittance basis taxation can be beneficial as it allows for tax to just be paid on directly brought over foreign income and gains rather than all earnings arising. That said though; domicile laws are intricate so outcomes of particular cases will differ depending on a range of circumstances involved.

Calculate your capital gains tax liability to determine how much you owe in taxes

HMRC’s Capital Gains Tax rate is based on your personal income. They add your taxable gains to your income, then they review the total of all taxable gains you have made in a year and place it within an Income Tax band to calculate how much tax will be due upon sale of property.

To calculate the taxable gains after your expenses and allowance, you:

- Take your taxable gains i.e. sold price minus purchase price equals taxable gain (net profit)

- Deduct any allowable expenses:

- Agent fees

- Legal fees

- Refurbishment costs

- Stamp duty

- Surveyor fees

- Deduct the Capital Gains Tax allowance

Example

Following on from the same example:

- You purchase a property for £250,000

- You sell the property for £650,000

- You spent £39,500 (based on an effective tax rate of 6.08%) on Stamp Duty and agency fees

- You spent £80,000 improving the property

- Your total taxable gain or net profit is: £650,000 – £250,000 = £400,000

- Your taxable gains after your expenses is: £400,000 – (£39,500 + £80,000) = £280,500

- Your taxable gains after your expenses and allowance is: £280,500 – £6,000 = £274,500

If your total taxable gains is less than the CGT allowance of £6,000, then you do not need to report to HMRC.

Exploring the various ways to reduce or defer your CGT liability, such as rolling over gains or using Entrepreneurs’ Relief

When it comes to selling residential property in the UK, capital gains tax (CGT) can significantly impact your bottom line. However, there are various ways to reduce or defer your CGT liability. For instance, you can take advantage of Entrepreneurs’ Relief, which reduces the rate of CGT to 10% on certain gains. Rolling over gains is another option, which allows you to defer CGT by reinvesting the proceeds into another asset. Additionally, transferring ownership of your property to trustees can also provide tax benefits, as trustees may be subject to lower CGT rates. By carefully considering these various strategies, you can greatly mitigate your CGT liability and keep more of your hard-earned profits.

Maximizing your profits with strategies such as utilizing losses, averaging, and claiming allowable expenses

When it comes to maximizing profits on residential property, utilizing losses and claiming allowable expenses can make a significant difference. In the UK, capital gains from property sales are subject to Capital Gains Tax (CGT), with rates of 18% and 28% depending on income. Averaging can also be a useful strategy, allowing individuals to spread out their gains over multiple years to reduce their overall tax liability. Additionally, trustees who hold property can take advantage of certain exemptions and reliefs to minimize their tax burden. By implementing these strategies and staying up-to-date on UK tax laws, investors can increase their profits and enjoy greater success in the property market.

Take advantage of other potential tax savings such as claiming residence nil rate band if applicable

As a homeowner in the UK, there are several tax savings that can be taken advantage of, especially when dealing with residential properties. Claiming the residence nil rate band is just one example. By doing so, you could potentially save thousands on inheritance tax. In addition, if you have sold a residential property, you may also qualify for capital gains tax (CGT) relief. There are different rates for CGT depending on your income and the type of asset sold. Currently, the higher rate of CGT is 28%, and the basic rate is 18%. However, it is worth noting that claiming this saving may not be straightforward and may require the assistance of a professional. Furthermore, if you have property that is being held in trust, there are additional complexities to consider. All in all, by exploring these avenues, you can find tax savings that you may not have known existed.