What it Could Mean for Your Property Investment in 2023

At their meeting ending on 22 March 2023, the Bank of England’s Monetary Policy Committee opted to increase Bank Rate by 0.25 percentage points in order to meet the 2% inflation target and sustain growth and employment. This increase in rate comes as a result of the risk of rising prices during periods of recession, affecting investors’ comfort with purchasing property or taking out mortgages. With this decision there will be a consequent rise in interest rates for many loan items as well as higher cost for businesses and government debt. Two members dissented, preferring to maintain Bank Rate at 4%, however their opinion was not enough to sway the majority. It remains to be seen what further impact this decision will have on economic stability going forwards.

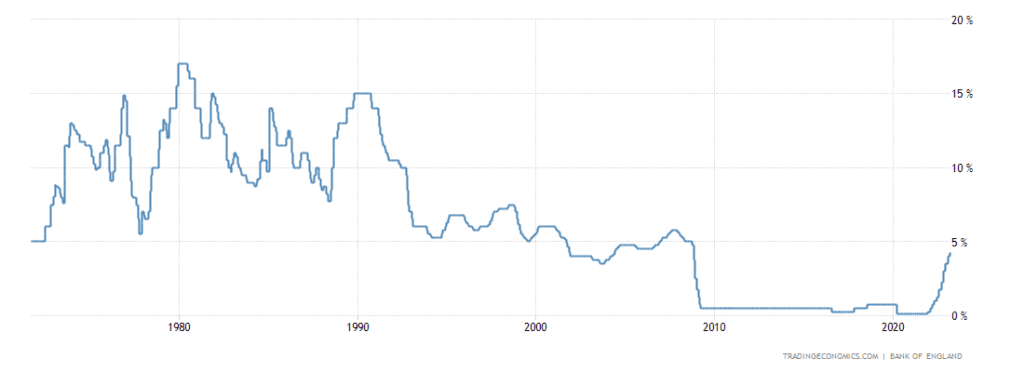

Interest Rate History

The current prime rate is low in response to the 2008 recession and the subsequent effects of inflation. Interest rates are key components that can affect individuals, businesses, investors, and other aspects of everyday life. On the other hand, certain investments in stocks and bonds may not offer attractive returns for investors with this historically low amount of interest rate generated income.

The prime rate is an indicator of how healthy the economy is. Generally, during times of recession or deflation, interest rates will drop while in inflationary times they rise. Taking out a loan or mortgage requires understanding what the current prime rate means as it directly affects your repayments. For example, during times when the prime rate drops, it may become easier to pay off debt or purchase property at lower rates than when rates are higher. On the other hand, investors have to factor this rate into their decisions about what kind of property to purchase for investment purposes and should take note of prime rate fluctuations. Ultimately then, knowing how shifts in the prime rate affect your own financial situation can provide greater control over your finances – both now and into the future. Overall, much of how the current prime rate affects an individual or business depends on their specific financial strategies and needs.

How to Prepare Your Finances for a Rate Increase

With the Bank of England raising interest rates to 4.75%, it’s time to think about how to protect your finances. The rate increase is in response to a recent period of economic recession, and is meant to guard against inflation. For many people, this rate raise may mean monthly mortgage payments will become more expensive; however, it can be seen as an opportunity for property investors, who may benefit from higher returns on their investment. When managing a household budget, the best way to prepare for this change is by reassuring yourself that it will not last forever and implementing strategies like adjusting your tax withholding amount and allocating funds into long-term investments, such as retirement or other saving accounts. Being proactive and prepared are two of the best ways you can positively manage your finances during a rate increase like this one.

With the Bank of England raising interest rates to 4.75%, it’s time to think about how to protect your finances. The rate increase is in response to a recent period of economic recession, and is meant to guard against inflation. For many people, this rate raise may mean monthly mortgage payments will become more expensive; however, it can be seen as an opportunity for property investors, who may benefit from higher returns on their investment. When managing a household budget, the best way to prepare for this change is by reassuring yourself that it will not last forever and implementing strategies like adjusting your tax withholding amount and allocating funds into long-term investments, such as retirement or other saving accounts. Being proactive and prepared are two of the best ways you can positively manage your finances during a rate increase like this one.

Tips To Help You Save Money During a Rate Increase

Saving money during a rate increase is no easy feat, especially in an era where recession and inflation combine to take their toll on your wallet. When interest rates rise, so does the cost of things like mortgages, property and investments; all of which can put tremendous pressure on you financially.

The good news is, by taking certain steps now, you can more easily weather the inevitable economic storm that rises with rate increases; it just requires a bit of planning and open-mindedness. Consider reducing fixed expenses as much as possible, making sound investments or investing in commodities or mutual funds that are likely to retain or grow value in tougher times. You could also research ways to reduce your mortgage costs without refinancing or look for other long-term opportunities to save money that will benefit you later when the rate increase has created a more favourable market for investors.

Understanding the Impact of a Rate Increase on Your Mortgage Payments

Whether the economy is flourishing or in a recession, it’s important to understand how a rate increase on your mortgage can impact your home payments. During times of inflation, interest rates tend to rise; this becomes a concern for people who have a mortgage secured through a bank, as their payments may become too expensive to afford. It can also be detrimental to investors of properties, lowering their potential return and giving them added stress that they may not be able to pay off the loan with increasing debt. Keeping track of current economic events, such as changes in inflation or interest rates, guarantees that you will be aware of any changes that could affect your finances and give you the time needed to make necessary adjustments.

Strategies for Homeowners Facing a Rate Increase

The UK is in a recession and homeowners are facing increased pressure due to inflation and rising interest rates. Although changes in the market can cause difficulties, there are ways to navigate them. In some areas, property prices have risen, making a good investment for those with financial stability. Within this context, it may be worth considering refinancing your mortgage at a fixed rate to help secure more security. Investors may also consider renting out part of their home or let properties in order to make more money from the property market. In either case, strategies like these can help alleviate the financial burden associated with rate increases on UK homeowners.

How To Re-Negotiate Your Mortgage With Your Bank After A Rate Increase

During a recession, it’s not uncommon for interest rates to fluctuate, often resulting in a rate increase on your mortgage. Although this may seem intimidating and disconcerting, you can still take the necessary steps to re-negotiate your mortgage with your bank in order to stop the inflation that occurs due to an increase in property prices. Before entering negotiations with your lender, be sure to research and compare market rates, discuss options available from other investors, and have a plan of action ready depending on the outcome of your talks. Although the process may take some time and effort, taking action to negotiate a better deal with your bank can save you considerable money over the life of your loan.

The Bottom Line

Finding your way to a more secure financial future can sometimes seem daunting, especially in light of rate increases. Fortunately, homeowners have more options than they may realize; by researching market rates, approaching other investors, and having negotiations ready with their lender, they can increase their chances of securing a better deal. No matter the situation, it’s always in everyone’s best interest to understand their options before making any decisions. If you’re looking for some professional help or guidance for this process, Properkeys Limited provides expert advice and assistance for homeowners facing rate increases. Sign up today and take control of your finances!