Annual house prices decline 3.1% in March

Overview of the housing market in March 2021

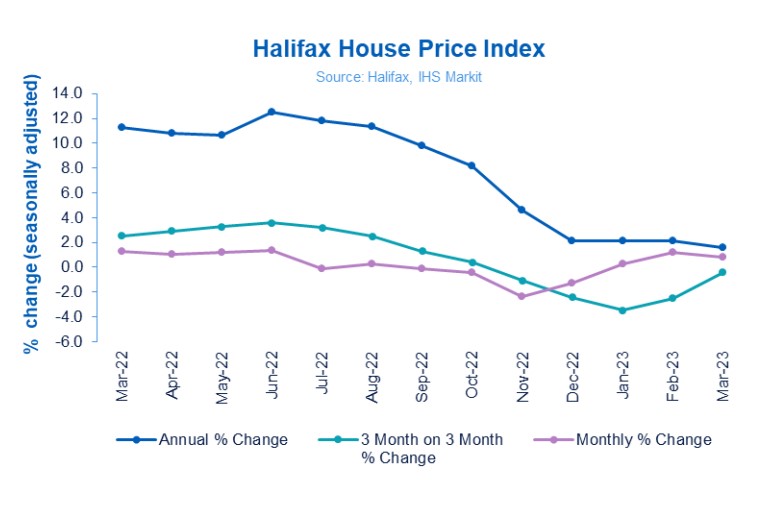

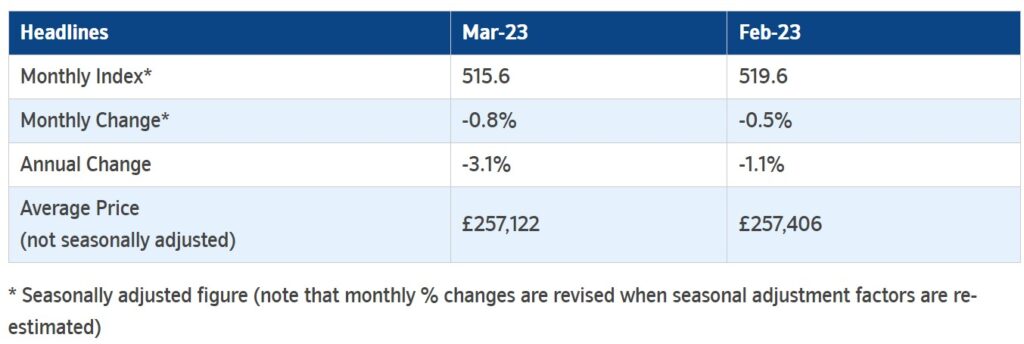

March 2023 saw the biggest annual decline since 2009 another dip in house prices across the UK, with the latest index from Nationwide showing a –1.1% decline compared to February’s figures. This marks the seventh consecutive month of falling prices, furthering concerns about the state of housing market and wider economy during uncertain times.

In March, the biggest annual decline in house prices since 2009 was observed – a 3.1% drop from last year’s figures. The slow-down of growth is visible across all regions with most witnessing small decreases over an extended period of time. Northern Ireland continues to report the strongest annual growth in house prices of +4.9% (average house price of £186,459), followed by the West Midlands (+3.8%, average property price of £248,308). while Scotland lagged behind others – continuing its rank as weakest performer overall; the annual rate of growth fell to +2.3% (average property price of £199,853).

Mike Scott, Yopa’s Chief Analyst says, “The Nationwide House Price Index for March shows house prices continuing to fall, with prices down for the seventh consecutive month and a 3.1% fall since March 2022. However, it should be noted that the Halifax figures for January and February disagreed with the Nationwide, showing house price increases in both of those months.

With that being said, it’s important for anyone looking for an overview on this subject to understand what factors are impacting this trend and how things could potentially change moving forward.

Through this post we’ll be taking an in-depth look at:

- Reasons for the 3.1% decline in house prices

- Impact on buyers and sellers

- What does this mean for the housing market going forward

- Ideas for making sure you get the best possible value when buying or selling a home

- Strategies to protect yourself from further declines in house prices

Reasons for the 3.1% decline in house prices

1. Natural Disasters

In 2020, fear was widespread, but this did not have an immediate impact on house prices. However, there are several reasons why this could cause an eventual yet temporary decline. Firstly, the fear of contracting and spreading the disease can result in people avoiding densely populated areas. Furthermore, disease can lead to a decrease in demand for property, as potential buyers may be hesitant to invest in an area that has more negatively been affected by the health crisis. Additionally, a surge in mortality rates resulted in some homes being abandoned, which could contribute to a surplus of supply, further driving down prices.

Regardless, in May 2020 when the markets reopened, buyers were having none of it; “…79% of buyers who had already agreed purchases before lockdown tried to reduce their price. Most succeeded, but not on the scale they were expecting,” says Lucy Pendleton, managing director of James Pendleton estate agency. “In all, 99% of them failed to achieve a reduction of more than 2.5%. The only exception has been a 6% reduction on a house that had been listed for sale at £2.5m.”

Despite house prices remaining high during the pandemic, these trends have started to see a reverse, and could continue to see a decline in the coming months.

2. Economic Downturn

We’ve already mentioned the pandemic. But, when the economy is struggling, people are typically less likely to buy or invest in property. This can lead to a decrease in demand, which in turn can lead to lower prices.

Homeowners and first-time buyers alike may be feeling unsure about their investments due to the current unsteady economic climate. The housing market is influenced by both supply and demand; therefore, an economic downturn generally leads to a decrease in home value if there are not enough people looking for properties.

I guess this was easily predictable, because on 8th July 2020, Chancellor Rishi Sunak announced a major initiative to give the UK housing market an injection of growth – stamp duty holiday! This would run until 31st March 2021, which meant no tax would have been payable on properties worth up to £500,000. Both first-time buyers and those who has already owned property could benefit from this enhanced savings opportunity when buying their home.

3. Interest Rates

Interest rates also play a role in property prices. When interest rates are low, it makes borrowing money for a purchase more affordable, which can lead to increased demand and higher prices. However, when interest rates rise, it can make borrowing more expensive and lead to decreased demand and lower prices.

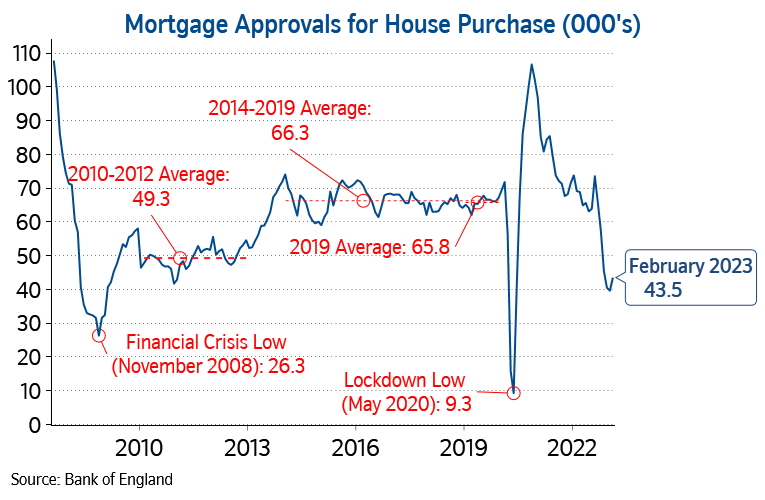

The recent tightening of restrictions surrounding mortgages has likely played a role in the decrease in house prices. When Bank of England raised the base rate, this caused mortgage payments to increase as well – meaning customers started to search out cheaper options which affects how much your house is worth on the market overall. According to recent reports, mortgage approvals in 2023 have fallen to levels that haven’t been seen since the financial crisis.

This news is particularly concerning for both homeowners and prospective buyers, as it suggests that the housing market is experiencing a significant slowdown. With the housing market forming such a crucial component of the economy, these troubles in the mortgage approval space could have far-reaching consequences if not addressed appropriately. It’s vital that policymakers and banks figure out ways to reverse this trend and inspire confidence in consumers once again.

4. Political Instability

Political instability can also lead to falling property prices. This is because when there is uncertainty surrounding a government or country, people may be less likely or willing to invest in property there. This can lead to decreased demand and lower prices.

5. Increased Supply

As previously mentioned, the health of an asset class is very much dependent on supply and demand. Where there is a decrease in demand, naturally that is followed by an increase in supply. For example, when new construction projects are completed or when more homes come onto the market for sale. When there is an increase in supply, it can put downward pressure on prices as buyers have more options to choose from.

6. Crime Rate

Finally, another reason why property prices may fall is due to an increase in the crime. People are typically less likely to want to live in an area that has a high crime rate, which can lead to decreased demand and lower prices. However, having said that, some areas prove to be a great early investment e.g. Stratford, before the Olympics were announced. Read this article by the Evening Standard to learn more about how getting in early, sometimes works out to be some of the best investments.

Despite these factors, experts are remaining optimistic for the future of the housing market, predicting that the decline will be a temporary setback in an otherwise thriving industry.

Impact on Buyers and Sellers

For buyers, a decrease in the cost of purchasing a home could offer a much-needed opportunity to enter the market. However, it is important to remember that a decrease in housing prices can also indicate a struggling economy or housing market, which may have long-term consequences for buyers. For sellers, a decline in house prices can be a cause for concern as it could mean a lower return on investment. It may also mean it takes longer to sell their property, leading to frustration and financial strain. Ultimately, a decline in house prices affects both parties involved in the housing market and navigating the potential impacts requires careful consideration and strategic decision-making.

What does this mean for the housing market going forward...

Some may see this as a warning sign of a looming economic crisis, while others view it as a potential opportunity to purchase homes at a lower price. One thing is for sure – this trend is likely to impact the housing market in various ways. For example, a decrease in home values could lead to lower property taxes and potentially boost buyer demand. However, it could also result in a decrease in new constructions and lower commissions for estate agents. It remains to be seen how this trend will progress, but it’s always important to stay informed on the latest developments in the housing market.

Strategies to protect yourself from further declines in house prices

This current decline in house prices can be concerning for homeowners and potential buyers alike. However, there are strategies that can be implemented to protect yourself from further declines in house prices. One approach is to consider purchasing a fixed-rate mortgage, which can provide stability and predictability in monthly mortgage payments. Additionally, staying up-to-date on the local property market and seeking the guidance of a trusted estate agent can help inform decisions on buying or selling. Keeping your home well-maintained and improving its value through renovations can also potentially mitigate declines in house prices. By being proactive and informed, homeowners and potential buyers can navigate the current housing market with confidence.