What are property investment cycles and how long do they last?

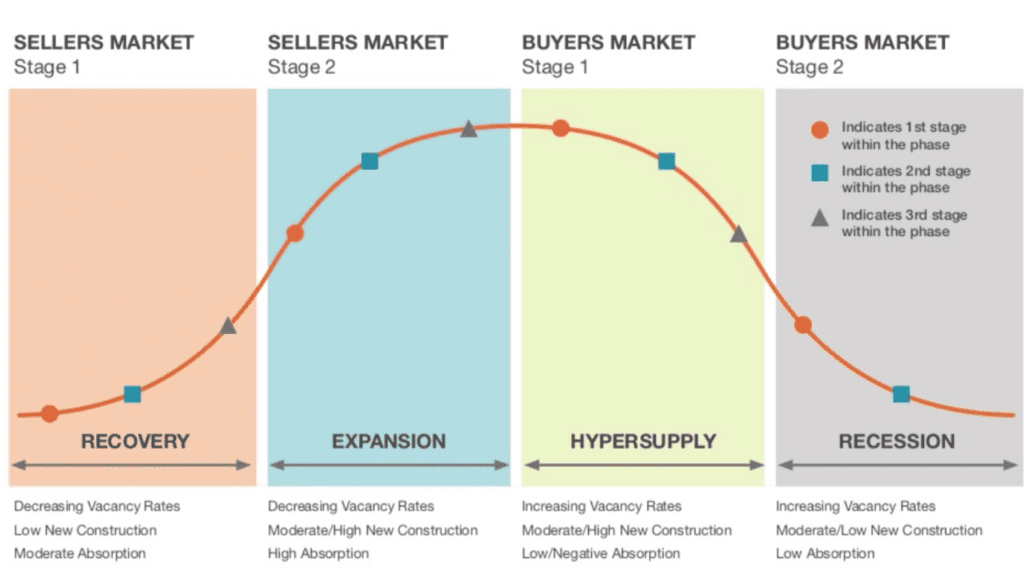

The property market cycles are a recurring pattern in the property market which can have a significant impact on property values and investment decisions. Generally, the property cycle includes four distinct phases: Recovery, Expansion, Hyper Supply, and Recession. Research has found that the average cycle lasts for approximately 18 years. By understanding how these factors interact with each other and how property markets change across different parts of the country or globe we are better able to inform our property investment decisions.

Why do housing cycles occur, and what factors contribute to them?

Changes in global economy and crises, population disparity, interest rates, and general economic health serve as influencing factors for housing cycles. These changes create a cycle of boosts and dips in housing investment, driving up prices at certain intervals in response to changes and dropping other times because of changes. Interest rates determine how much access buyers have to money or credit when considering a house purchase, so changes in these rates can affect the market in particular if they become more expensive or cheaper respectively.

Global crises cause all kinds of changes which indirectly impact the housing market – during an economic crisis in one part of the world, people may choose to migrate elsewhere seeking cheaper property. Therefore, sudden influxes or declines in population create an imbalance that affects house prices significantly. In short, numerous external factors can interact to let us anticipate the behaviour of property investments with some degree of accuracy.

The four stages of a housing cycle

There are four stages to the housing cycle; Accumulation, Expansion, Contraction, and Recession.

- Accumulation – During Accumulation, population demographic shift causes changes in global economies and increase the demand for housing.

- Expansion – Expansion follows when these changes start increasing rents and house prices which attract more investors.

- Contraction – During Contraction, changes start to slow down as increases of global interest rates make borrowing more expensive for prospective buyers hence reducing demand from investors.

- Recession – The last stage; where changes in global crisis can cause markets to crash disproportionately due to population disparity followed by decreases in loan demands that leads to banks raising interest rates for lenders even more. At this stage, people will have a hard time finding reliable financing options making it difficult for them to invest into properties.

How to spot which stage of the cycle your local market is in, and what should you do about it?

Property investment can offer lucrative returns if you know what to do and when. By understanding housing market cycles, investors can develop strategies that capitalize on rising property values and make money from buying, selling and renting out properties.

Spotting market cycles is essential for any savvy investor. When it comes to larger market cycles, like the housing market, it’s critical to have an idea of what stage it’s in so that you can make informed decisions about not just buying and selling but also about whether or not you should join the market at all. Spotting the stage of a market can be difficult, but there are some tell-tale signs to look out for. Things like market volume, current stock prices and economic health are all indicators of which market cycle you’re looking at. Once you’ve identified the market’s stage, explore your options.

Perhaps now is a good time to start thinking about your entry points, as prices begin decline. UK home prices experienced a staggering decline in December, dropping 1.5% from the previous month and more than halving their annual growth rate from 4.6% to 2%. Falling to £281,272 for an average property cost, homeowners are feeling uncertain about continued stability of the housing market.

Maybe it is best to remain on the sidelines, until further changes occur. Prices forecast to slump 8% in 2023. Either way, by understanding how to spot market cycles, you’ll be able to make intelligent choices within today’s markets.

Strategies for investors at each stage of the cycle, and what are the risks involved?

Whether you are a first-time investor or an experienced market participant, understanding market cycles and utilizing the right strategies is essential for property investors. It’s important to be able to spot market stages, understand what drives them, and know what to invest in at various points of a market cycle. During an uptrend, buying property early allows investors to receive higher returns on their investments through appreciation. Investors should evaluate rental market conditions, rent prices and target specific residential neighbourhoods when looking to purchase during a market peak. On the other hand, if we are in a market decline, buying property is often cheaper due to suppressed demand and property prices. In such cases, investors should look at leasing opportunities instead of buying since very low-priced distressed properties may still be subject to further depreciation before long term holdings become profitable. Research carefully and aim to minimize costs in the short-term while guaranteeing positive cash flow long-term.

Bearing in mind, like any investment there are risks involved – the market fluctuates from day to day, housing markets may take un-forecasted turns and rental demand may also be volatile. Understanding market cycles can be invaluable for investors trying to navigate the housing market. As a result, different strategies should be employed depending on which stage of the cycle investors are in. It is worth bearing these potential pitfalls in mind when exploring ways to make money from property investment cycles. Ultimately understanding market cycles and knowing when it is beneficial to invest more defensively or offensively are essential strategies for success at any stage of investing.

What are the key things to remember when investing in property during a boom or bust cycle?

Property investment cycles happen all over the world, and they can have a big impact on your returns as an investor. It’s important to understand why they occur, and how you can use them to make money from property investing. If you’re thinking of getting into the property market, Properkeys Limited is a great resource to help you get started. Sign up today to learn more about how you can make, save, or secure your investments during this market cycle.